Introduction: Why Invest in NEPSE?

The Nepal Stock Exchange (NEPSE) offers a great opportunity for Nepalese investors to grow their wealth by investing in publicly listed companies. Whether you want to build a retirement portfolio, generate passive income, or save for the future, investing in NEPSE can be lucrative.

This guide will take you step-by-step through the process, from opening a DEMAT account to purchasing your first stock.

1. What is NEPSE?

NEPSE, short for Nepal Stock Exchange, is the only stock market in Nepal. Investors trade shares of publicly listed companies in sectors such as banking, hydropower, and insurance. Investing in NEPSE allows you to participate in the growth of these companies and potentially earn dividends or capital gains.

Visit the NEPSE website to check the latest stock performance and market indices.

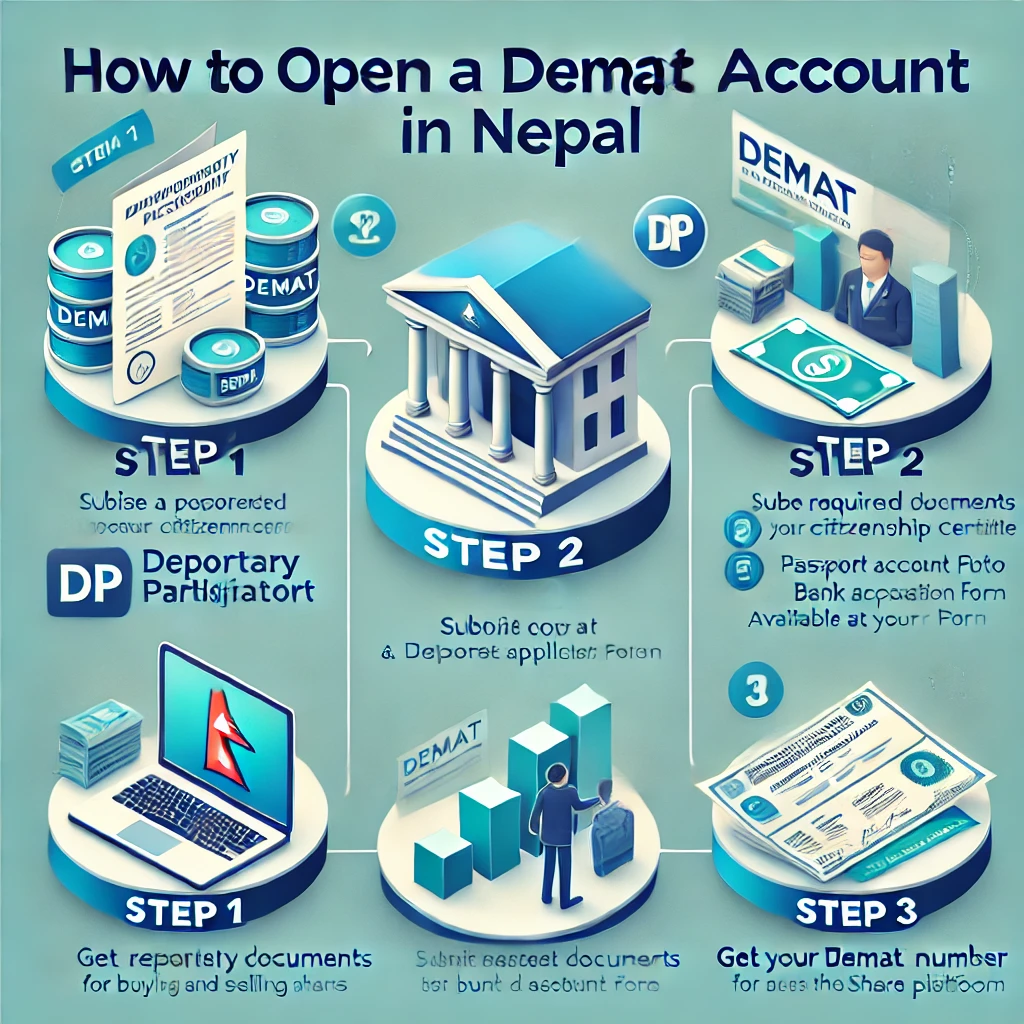

2. Step-by-Step Guide: How to Open a DEMAT Account

To trade on NEPSE, you need a DEMAT account. A DEMAT account holds your shares electronically, making it essential for buying and selling stocks.

Steps to Open a DEMAT Account

- Choose a Depository Participant (DP)

A DP is typically a bank or financial institution that helps you open a DEMAT account. Popular DPs in Nepal include: - Submit Required Documents

You’ll need:- Photocopy of your citizenship certificate

- Passport-sized photo

- Bank account details

- DEMAT application form (available at your DP)

- Get Your DEMAT Number

After submitting your documents, you’ll receive your DEMAT account number, which you’ll use to buy and sell shares and access the Meroshare platform.

3. Trading Using Meroshare

Once you have your DEMAT account, you’ll need to register for Meroshare. This platform allows you to buy and sell stocks, apply for IPOs, and manage your portfolio.

Steps to Register for Meroshare:

- Visit the Meroshare website.

- Click on Sign Up, select your Depository Participant (DP), and enter your DEMAT account number.

- Complete the registration and receive your login credentials.

Once registered, you can access your Meroshare account to start trading.

4. Choosing a Stock Broker in NEPSE

To trade stocks, you’ll need a licensed stockbroker. Stock brokers act as intermediaries between you and the NEPSE.

Trusted Brokers in Nepal:

(Please do your research before selecting a Broker. Below provided are some examples)

Things to Consider:

- Trading Fees: Compare the brokerage fees across different brokers.

- Customer Support: Choose brokers with responsive customer service.

- Online Trading Platform: Most brokers offer user-friendly platforms where you can place buy/sell orders easily.

5. How to Make Your First Stock Purchase

Now that your DEMAT account and Meroshare registration are complete, it’s time to make your first stock purchase.

Steps to Buy Your First Stock:

- Fund Your Trading Account

Deposit funds into your trading account linked to your broker. - Research Stocks

Before buying stocks, research the company. Look at key factors such as:- Earnings Per Share (EPS): A higher EPS suggests greater profitability.

- Price-to-Earnings (P/E) Ratio: Helps determine if a stock is overvalued or undervalued.

- Company Performance: Review the company’s growth potential and financial health.

Example Stock Analysis

ABC Hydropower (NEPSE: ABC)

- EPS: 15.4

- P/E Ratio: 10.2

- Dividend Yield: 3%

From this analysis, ABC Hydropower appears to be a solid long-term investment due to its steady profits and reasonable P/E ratio.

- Place Your Buy Order

Log in to your brokerage platform and enter the stock symbol (e.g., ABC), the number of shares, and the order type (market or limit).

6. Risks and Rewards of Investing in NEPSE

Risks:

- Market Volatility: Stock prices fluctuate due to local and global factors.

- Liquidity Issues: Some stocks in NEPSE may not be easily sold due to low trading volume.

- Regulatory Changes: Government policies and regulations can affect stock performance.

Rewards:

- Capital Appreciation: Stocks often provide higher long-term returns compared to savings accounts.

- Dividend Income: Many companies in NEPSE offer dividends, providing regular income.

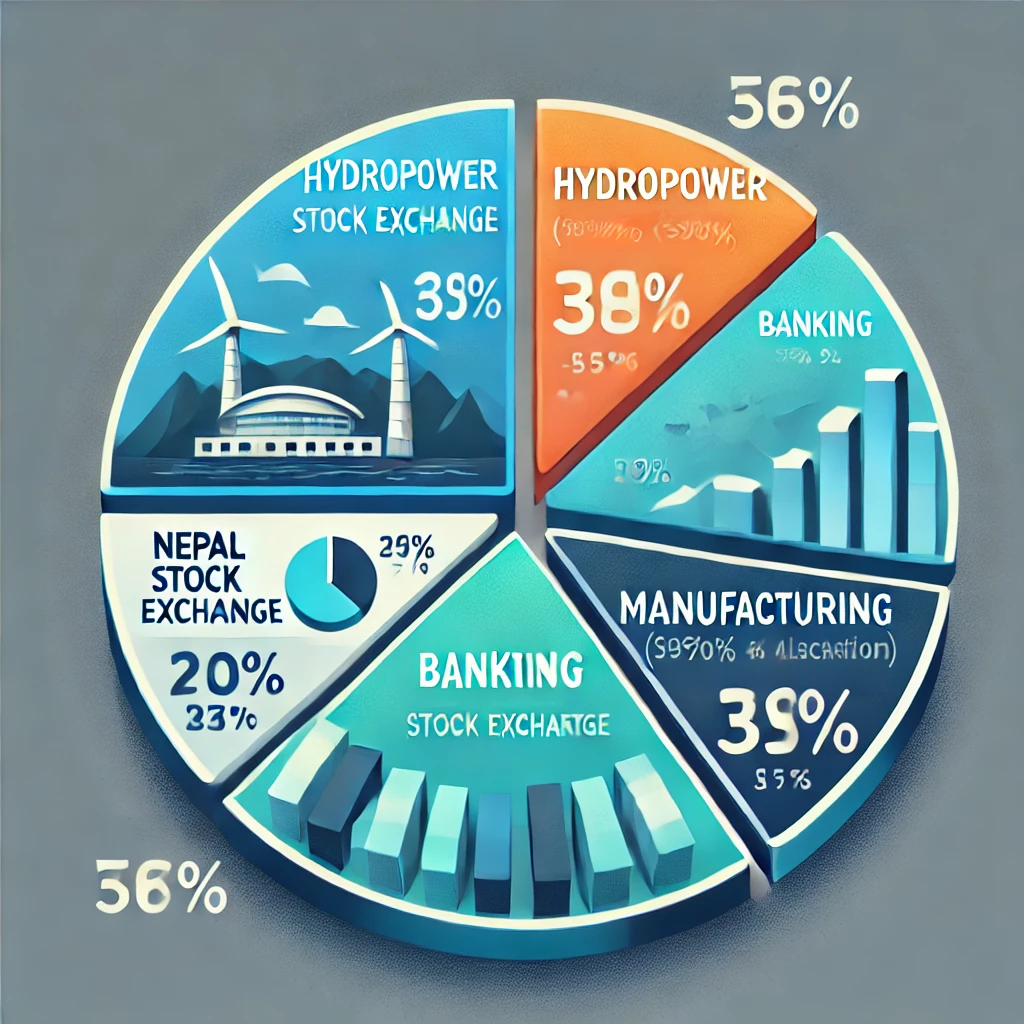

- Portfolio Diversification: Investing in multiple sectors (e.g., banking, hydropower) reduces overall risk.

Example of Portfolio Diversification in NEPSE

7. Tools and Resources for Nepalese Investors

To become a successful investor in NEPSE, you need to use the right tools. Here are some essential ones:

- NEPSE Website: Track stock prices, market indices, and company performance.

- Meroshare: Manage your portfolio, apply for IPOs and trade stocks.

- Google Finance: Monitor international stocks, financial news, and global trends.

Conclusion: Start Your Investment Journey Today

With your DEMAT account, Meroshare registration, and broker setup, you’re ready to begin investing in NEPSE. Through research and careful planning, you can build a profitable portfolio. The key to success in investing is to stay informed, diversify your portfolio, and keep a long-term perspective.

Ready to invest?

Subscribe to our newsletter to get the latest stock picks, market updates, and expert insights on NEPSE investing.

Call to Action (CTA):

Subscribe to Our Newsletter

Get the latest stock market analysis, news, and expert advice on NEPSE.

Subscribe Now

I am grateful for your post. I’d really like to say that the expense of car insurance differs a lot from one insurance policy to another, given that there are so many different facets which play a role in the overall cost. Such as, the make and model of the motor vehicle will have a tremendous bearing on the fee. A reliable ancient family vehicle will have a lower priced premium compared to a flashy expensive car.

I’d like to find out more? I’d love to find out more details.